November, Friday 20th., 2020

The COVID Feedback Loop

In the first of a three-part series published by Bank of America, the bank's global economist Ethan Harris looks at the theoretical feedback loops and trends linking the economy and coronavirus, focusing on how changes in consumer behavior resulting from the pandemic are impacting the economy.

Having analyzed "many countries and multiple episodes" of covid around the world, Harris has seen a "simple cycle in countries that have not contained the virus" which is as follows:

-

When COVID cases come down, both individual behavior and official rules are eased.

-

With a multi-week lag that boosts the economy.

-

However, it also allows the virus to come back.

-

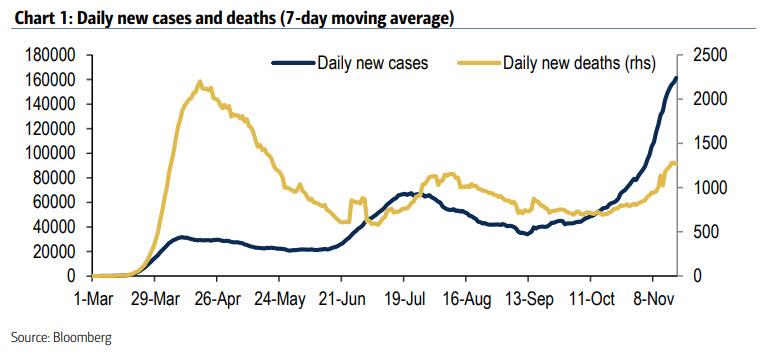

Finally rising cases lead to rising hospitalizations with about a two week lag and that in turn leads to higher fatalities with another two week lag.

Visually:

While at the top-level it really is that simple, and is why any partial future lockdowns are doomed to failure while a comprehensive, long-term lockdown would destroy the economy, BofA notes that on top of this cycle there are both positive and negative secular trends. On a positive note:

-

Learning by doing: people figure out how to function in a COVID world, without severe shutdowns. This happens over time as regions experience the virus surge first hand.

-

Super spreaders stop spreading: some people spread the virus a lot more than others, but they likely get the virus early on and are no longer spreaders.

-

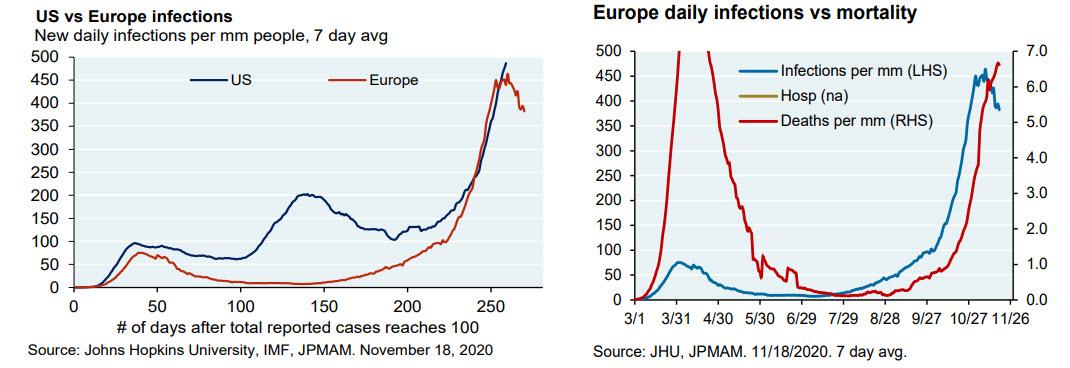

Treatments improve: death rates are much lower than they were in the spring, although they stopped dropping in early August.

-

Protect the vulnerable: the virus is much more dangerous for old people and people with comorbidities. Better testing, tracing and quarantining of these groups has helped lower the death rate as well.

At the same time, there are also some negative trends:

-

Pandemic fatigue: people have become tired of the weird world of social distancing and have started to take more chances. They are also tired of shutdowns and are increasingly willing to accept worsening public health for a more open economy.

-

Super spreader events: a related trend is the increased incidence of “super spreader” events, including in-person voting, election-related protests/celebrations and the approaching holiday season.

-

Cold weather: in the summer, surging cases in the US were contained in part by moving activities outdoors. That option is not available in the Northern Hemisphere as temperatures continue to drop.

-

Fading fiscal backstop: in the spring and summer, local authorities in the US and elsewhere could lean on a generous fiscal backstop, knowing that workers and businesses would be compensated for the COVID shock. That is now no longer the case, forcing very tough choices.

As Harris concludes, "all of this is playing out as we speak" as rising cases are beginning to alter behavior and that is beginning to impact the economy.

But, due to the circular nature of the covid-economy relationship, there are already hints of slowing case growth, especially in Europe where new cases have peaked.

Whether that continues depends heavily on what happens in the months ahead. Meanwhile the lags will play out, with slowing economic growth, which may drag the Fed out of hibernation and force it to stimulate monetarily if Congress remains gridlocked and unable or unwilling to pass another massive stimulus.