The new "...Lagarde's mission creep..." m.l.p.

Over the weekend Minneapolis Fed chair Neil Kashkari suggested it was time to allow central banks to directly decide how to redistribute wealth, stating unironically that "monetary policy can play the kind of redistributing role once thought to be the preserve of elected officials", apparently failing to realize that the Fed is not made up of elected officials but unelected technocrats who serve the bidding of the Fed's commercial bank owners.

Failing to decide how is poor and who is rich, central bankers are happy to settle with merely fixing the climate.

Overnight, Bank of Japan Governor Haruhiko Kuroda joined his European central banking peers by endorsing government plans to compile a fiscal spending package for disaster relief and measures to help the economy stave off heightening global risks. Kuroda said that natural disasters, such as the strong typhoon that struck Japan in October, may erode asset and collateral value, and the associated risk may pose a significant challenge for financial institutions, Kuroda said.

“Climate-related risk differs from other risks in that its relatively long-term impact means that the effects will last longer than other financial risks, and the impact is far less predictable,” he said. “It is therefore necessary to thoroughly investigate and analyse the impact of climate-related risk.”Kuroda's crusade to tame climate came just hours after the ECB's new chief, Christine Lagarde pushed for climate change to be part of a strategic review of the European Central Bank’s purpose, "spearheading a global drive to make the environment an essential part of monetary policymaking."

As the FT put it, the plan "underlines Ms Lagarde’s declared goal as president to make climate change a “mission-critical” priority for the central bank. It comes as European Commission president Ursula von der Leyen, whose team on Wednesday was officially endorsed by the European Parliament, is about to unveil her first landmark climate policy package.

“We have reached the point where the reputational risk of doing nothing is large enough that they will have to announce something at the end of the review — the big question is what,” said Stanislas Jourdan, head of Positive Money Europe, a campaign group.

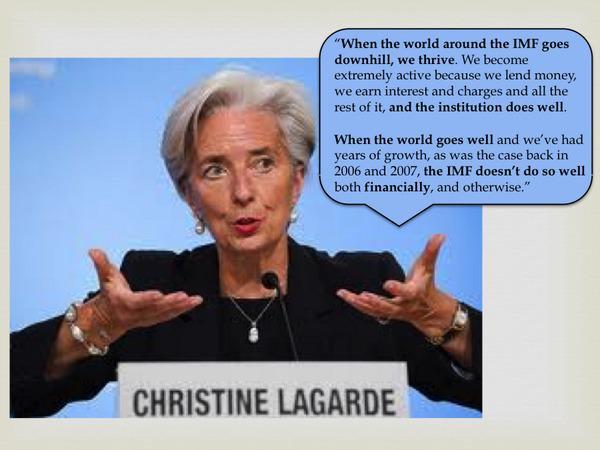

Funny Jourdan should bring up reputational risk: after all he was referring to the criminally convicted former IMF head, who recently incinerated tens of billions in IMF bailout funds in Argentina. The same former IMF head who in April 2016 admitted that for the IMF to "thrive", the world has to "go downhill", and that the IMF "to be sustainable" it needs to be "very in touch with our client base" while adding that "when the world goes well and we’ve had years of growth, as was the case back in 2006 and 2007, the IMF doesn’t do so well both financially and otherwise."

Naturally, Lagarde's attempt to hijack the ECB's mission from one of failing to hit an inflation target for years, diverting from Mario Draghi's disastrous bubble legacy, and from making the wealth divide between the rich and poor the widest it has ever been, and to one of virtually unlimited debt

monetization and MMT under the virtue-signalling guise of monetizing fiscal deficits to "save the climate" was promptly frowned upon by real central bankers such as Bundesbank president Jens Weidmann, who said last month that he would view “very critically” any attempt to redirect ECB monetary policy actions to tackle climate change. Then again, as has long been the case, the general public is by now well aware of Weidmann's "bad cop" act - when push comes to shove, the German always folds, he will fold again.

It wasn't just Weidmann who was appalled by Lagarde's mission creep. Overnight, Rabobank's Michael Every wrote that "just 24-hours after the Daily made the joke that said central banks will be adding a CO2 target to their CPI target, we see the Financial Times report that ECB President Lagarde wants a key role for climate change in the upcoming ECB review; this is apparently being opposed by the Germans, who believe that central banks are only supposed to focus on not-getting CPI right."

To be sure, Lagarde's half-baked strategy prompted even more questions the answers. Here is Every again:

Is Lagarde suggesting the ECB’s balance-sheet expansion will only be targeted at firms who meet green criteria? That’s going to cause a rapid liquidity crunch if so. Or is it that the ECB will back de facto fiscal expansion provided the scheme address global warming? “Cli(MM)a(T)e crisis”. I am not taking a side on that debate by the way, which is literally life or death if you believe the science: I am just asking how this is not something that elected politicians shouldn’t be front-running – does central-bank independence now run into the meteorological? And very sadly, commentary in Nature today suggests we might already be past the tipping point on the climate anyway – which would ironically be par for the course for central banks, who are always fighting the last war and failing to meet their targets.That was nothing, however, compares to full-on rant unleashed by Shard Capital's Bill Blain in his latest daily letter:

And on the “let’s reduce inequality” front the Fed’s Kashkari recently floated as another focus for central banks, are we perhaps to see the Fed’s balance-sheet expansion channelled to low-income housing, or to firms who help #MAGA? “#M(MMT)AGA” springs to mind if so. Or are they going to keep things simple and merely tell banks they have to charge rich people more in order to give subsidised loans to poor people?

None of this really suggests higher rates or yields, of course.

US Federal Reserve Chairman Jerome Powell was recently asked what he thought about tax cuts, and replied it was not the Fed’s job to comment on political initiatives – he made clear the US Central Bank will stick to the data to deliver on its mandate of price control and employment. Simple Stuff and Very Focused.

Compare and contrast to the situation in Europe. New ECB head Christine Lagarde is demanding a key role for the ECB in Climate Change. I thought the ECB was a central bank? Silly me. Bravo for her strident virtue signalling of her impeccable climate change credentials. I would propose a round of applause – but let’s give her Jazz Hands in case it offends anyone.

The gods of unintended consequences are going to have a fantastic time!

I was also under the impression The ECB was an element within some form of democracy at the centre of Europe where elected governments would determine policy. Apologies if I misunderstood.

Just how will the ECB address climate change? Will it impose punitive capital costs on banks lending to borrowers they deem non-climate worthy? Will it jail bankers and financiers that have the temerity to offer terms to Oil, Gas and Coal companies? Will the Bank only buy bonds issued by green borrowers who pass their tests? How will the bank police its green lending – for instance creating a Ministry of Financial Climate Control and basing it in Luxembourg…? How will it address Greenwashing? (By selling its own Green label perhaps?) What incentives and punishments will it have at its command?

The potential for market distortion is multiple and serious.

I would suggest the remit of the ECB might stick with the knitting – like how to get European agreement on the obvious stuff like Banking Union, how to address the need for Fiscal policy, rather than trampling all over National State’s rights to address climate change themselves.

No Matter. Lagarde is French and Europe belongs to Macron.

Any company that is well run, efficient and has positive cash flow, but is tarred by some Not Green badge, is going to be a screaming buy if you legislate against it – because it will be a good and cheap company. Giving a company a green badge does not make it a good company. It means it got a gold star - nothing more.

Well, Bill, if we wait just a few years you will surely get your wish.

Finally, just in case Every and Blain's sarcasm was lost on someone, here is Cantillon's Sean Corrigan pointing out that what central bankers are currently pushing is "backdoor, globalist imposition of anti-democratic #Green tyranny, nothing less 2.0C + 2.0CPI = CCCP2.0."

He is, of course right.